It was created in 1935 and typically makes up almost one-fifth of total federal spending.

Today, we look at the program 66 million Americans rely on called Social Security.

Social Security was created with the goal of providing economic security to the nation’s elderly; it was expanded in the 1950s to include support for the disabled. The program is operated largely on a pay-as-you-go basis: current employers and employees contribute taxes that fund benefits to retired workers and survivors in the Old-Age and Survivors Insurance program, as well as disabled workers and their families under the Disability Insurance program.

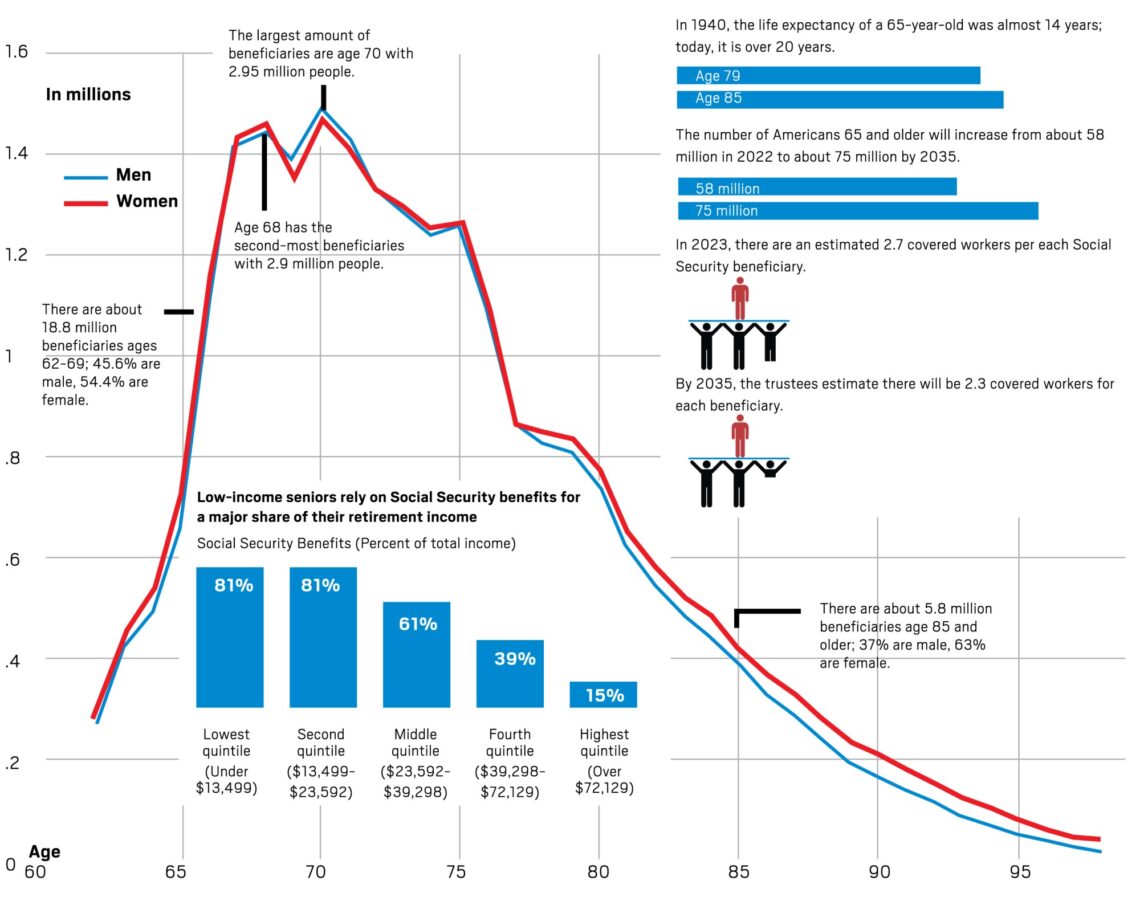

Social Security is the largest program in the federal budget. The program provides benefits to about 20% of the American population. Nearly 9 out of 10 individuals over the age of 65 receive benefits, and those benefits represent about 30% of total income to older Americans.

THEN AND NOW

HOW IT IS FUNDED?

Social Security is mainly funded through a dedicated payroll tax created by the Federal Insurance Contributions Act. Employers and employees each pay 6.2% of wages, with a cap on the amount of wages subject to the tax ($160,200 for 2023, adjusted annually for growth in economy-wide wages).

Those who are self-employed pay both the employee’s and the employer’s share of the tax. Those revenues are credited to the OASI and DI trust funds, which keep track of the programs’ receipts and expenses.

The programs also receive income from a tax on Social Security benefits paid by higher-income beneficiaries, as well as income generated by the investment of the trust fund reserves in non-marketable U.S. Treasury securities. However, from the perspective of the government’s overall budget, the interest income paid to the trust funds by the Treasury has no effect. Although it is a receipt to the trust funds, it is an equal dollar expense to the Treasury.

You can see you many beneficiaries there were each year here and you can see the…

Read the full article here