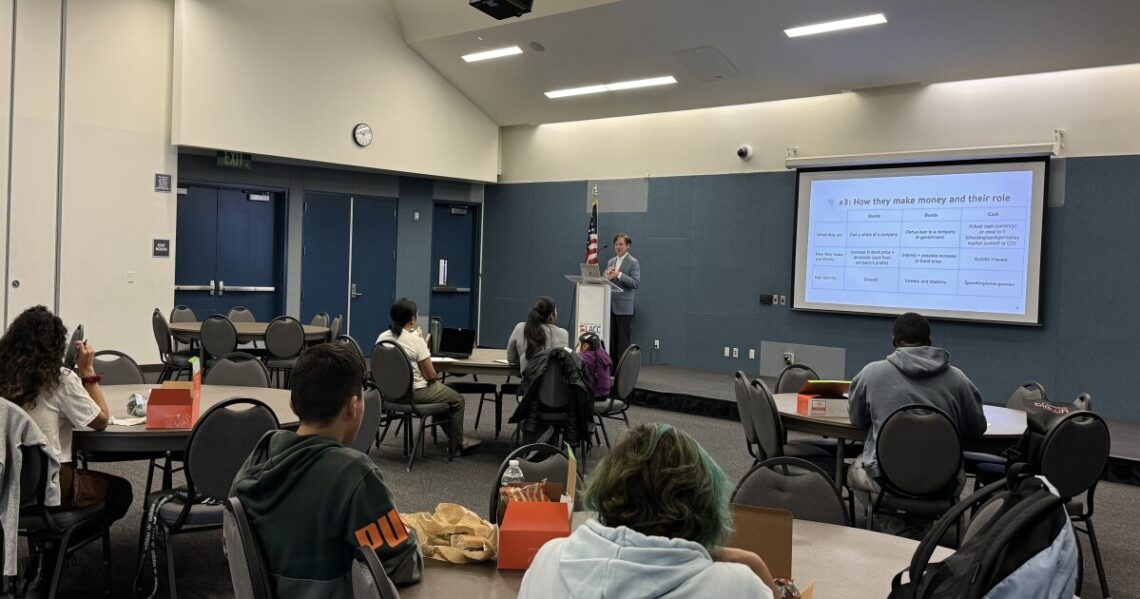

On a recent spring afternoon, about a dozen students gathered in Los Angeles City College’s multipurpose room for a free financial literacy workshop.

Some of those students are majoring in business administration or finance. A few are working on a second degree. One attended with her child.

The students have unique personal goals, but all of them want greater control over their financial futures.

The lunchtime event was the second of two 90-minute sessions, which covered everything from personal spending to saving up for retirement.

“My hope is that, at the end of two sessions, [students] can say, ‘I can do this,’” said Bruce Miller, who taught the workshop. He is now retired after a career in marketing and advertising. Miller has hosted similar courses at community colleges and universities across the country, including Stanford and Dartmouth, his alma maters.

“[Students] can learn to save, they can learn to get out of debt, they can learn to invest — and [they won’t] have to pay some enormous fee to somebody to do it for them,” he added.

More than a third of California community college students are the first in their families to attend college. As a result, Miller said, many will also be the first in the position to save for retirement. He wants them to be prepared to make sound financial choices.

Demystifying finances

Miller began the day’s session by asking students what they’d done to scale back on expenses since their last meeting. One student shared that she’d examined her entertainment subscriptions, determined which ones offered the best deals, and made some cuts. Another student said she’s making fewer…

Read the full article here