By Ari Natter and Keith Laing | Bloomberg

The Biden administration will allow more crossover SUVs to qualify for the newly-revamped electric vehicle tax credit following lobbying by automakers such as General Motors Co. and Stellantis NV.

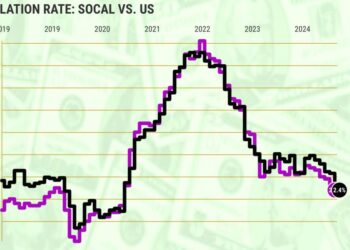

The change announced Friday by the Treasury Department effectively expands the number of buyers who can take advantage of a lucrative $7,500 consumer tax credit by broadening the definition of how a sport-utility vehicle is defined. The tweak matters because, under Democrats’ Inflation Reduction Act, SUVs costing up to $80,000 can receive the tax credits, while passenger-car buyers get nothing if the vehicle costs more than $55,000.

Specifically, Treasury said it would begin using the Environmental Protection Agency’s fuel economy labeling when deciding which vehicles qualify for an SUV. The adjustment is retroactive to Jan. 1, meaning consumers who already bought vehicles under the new definition can get the credit, the agency said.

Shares of US automakers were mixed, with General Motors and Tesla Inc. trading higher. Ford Motor Co., which reported disappointing earnings on Thursday, tumbled as much as 11%.

“This change will allow crossover vehicles that share similar features to be treated consistently,” the Treasury Department said in a statement. “It will also align vehicle classifications under the clean vehicle credit with the classification displayed on the vehicle label and on the consumer-facing website FuelEconomy.gov.”

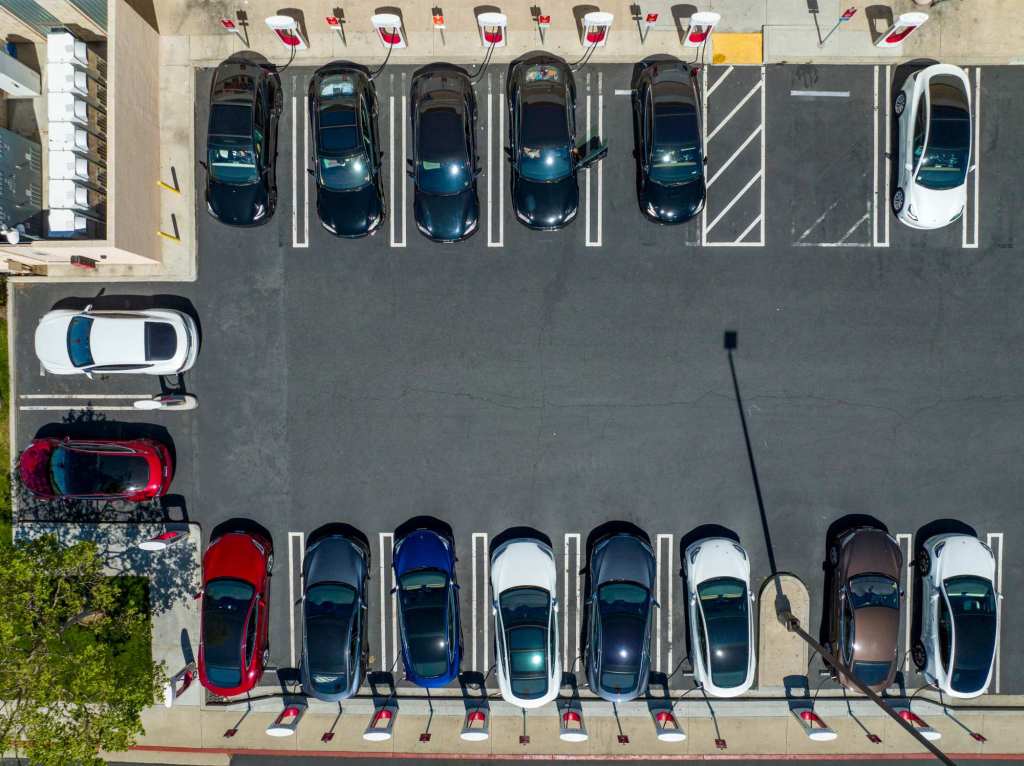

The move to eschew a more narrow SUV definition is a victory for automakers like GM and Stellantis, which pushed for the change. It means models like GM’s new $63,000 Cadillac Lyriq and high-end versions of Ford Motor Co.’s electric Mustang Mach-E. and Tesla Inc.’s Model Y, which the Treasury previously considered cars, can qualify for credits.

The news comes as Ford and Tesla recently cut prices on the Mach-E and Model Y due — at least in part — making them qualify under the…

Read the full article here