Can falling mortgage rates – whenever that happens – revive homebuying in Orange County?

Let’s first look at the lethargic sales pace. In the 12 months ending in August, just 28,981 Orange County homes sold, according to CoreLogic data. That’s 42% below the homebuying pace of two years earlier.

This drop is linked to drastically falling affordability in the pandemic era.

The county’s median price in August hit $1.09 million – the highest ever – and is up 45% since February 2020. Meanwhile, mortgage rates soared to 7.1% from 3.5%. A typical OC buyer saw house payments surge 117% to $5,839 monthly, assuming a 20% down payment.

My trusty spreadsheet reviewed how homebuying moved against big rate swings dating back to 1988. This 416-month span was sliced into thirds – ranking the results by one-year moves in the average 30-year fixed mortgage rate from Freddie Mac.

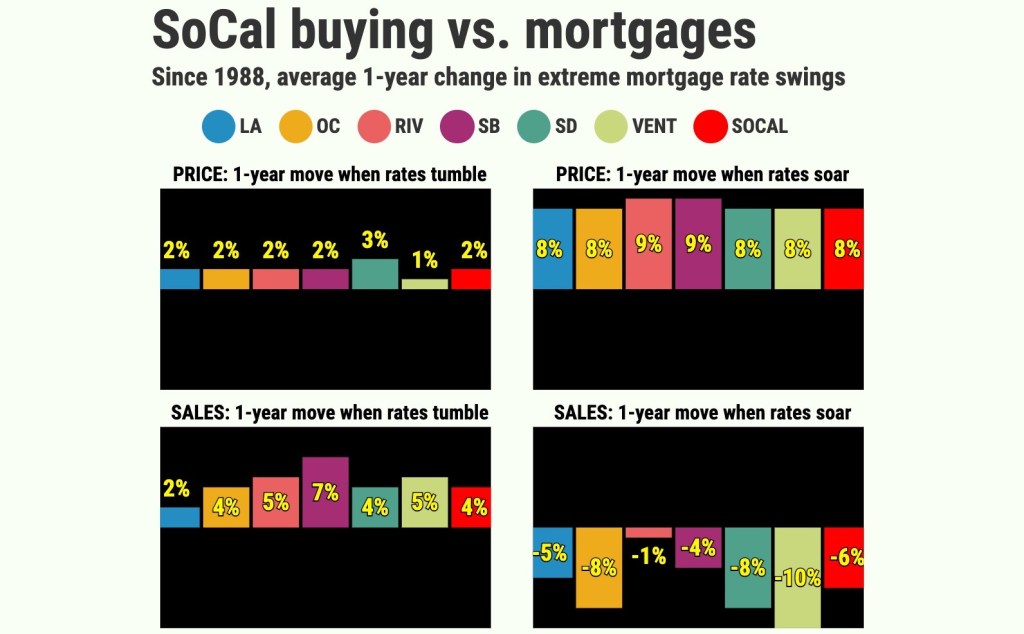

We contrasted the periods when rates surged the fastest vs. times when they tumbled the most. Both groupings averaged 1 percentage-point moves over 35 years.

The swings

Ponder how OC homebuying gyrates during these rate-swing extremes.

Let’s start with pricing. When mortgage rates were in their steepest jumps, home values in OC averaged 8.5% one-year gains.

Yet when mortgage rates were in their steepest drops, median home prices in OC saw 2.3% gains.

By the way, the local median price has appreciated 5.1% since 1988. So cheaper financing for house hunters could mean softer pricing, too.

- REAL ESTATE NEWSLETTER: Get our free ‘Home Stretch’ by email. SUBSCRIBE HERE!

And falling rates modestly boosted the OC homebuying pace, historically speaking.

Sales gained an average of 4.4% in the 12-month periods with the largest rate drops.

When rates increased rapidly, however, the pace of closed transactions fell – averaging 7.9% one-year losses.

The secret sauce

There’s a catch to lower rates – housing’s three magic words: “Jobs, jobs, jobs.”

Rates are usually rising…

Read the full article here