Orange County’s more affordable housing has been hit harder by the home-price collapse coming off May 2022’s pandemic-fueled bubble.

The countywide median selling price was $950,000 in January, according to CoreLogic. That’s off 10% from the $1.054 million peak set in May 2022 as prices surged 41% from February 2020.

My trusty spreadsheet found deeper drops among cheaper homes. That could be good news for budget-minded house hunters — if they’re willing to dive into a market unsettled by numerous economic question marks.

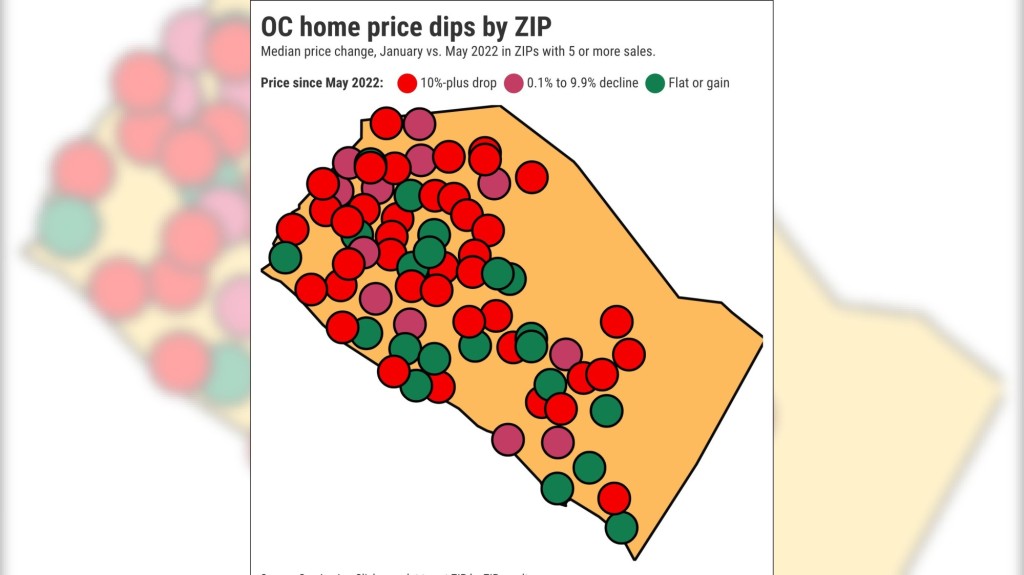

Depreciation was fairly widespread in this downturn. Looking at ZIP codes with five or more sales in January, 52 of 73 Orange County ZIP codes had price declines since May 2022’s top – that’s 71%.

But note this gap: Of the 42 ZIPs with medians under $1 million, 36 had price dips since May 2022, or 86%. Compare that to the 31 ZIPs with medians of $1 million or more with 16 price drops, or 52%.

Numerous factors fuel falling home values. The past year’s soaring mortgage rates slashed already low affordability rates. Life returning to a new normal after the pandemic shrank many house hunters’ need for larger places to live.

As a result, homebuying froze. Between June and January, 23,067 Orange County homes were sold. That’s down 33% from the same eight-month period a year earlier during the homebuying binge.

And talk about a stunning statistic: We just witnessed the second-slowest June-to-January sales pace since 1988, trailing only 2008 in the middle of the Great Recession crash.

And with mortgage rates stubbornly in the 6% range – roughly double last year’s rates – falling prices haven’t spurred much interest in buying.

Lower price, bigger dip

Orange County’s steeper price drops for cheaper housing aren’t terribly surprising.

Folks who’ll pay less for housing tend to have relatively weaker finances. Recent economic gyrations, notably high inflation, are a bigger headache for smaller household checkbooks….

Read the full article here