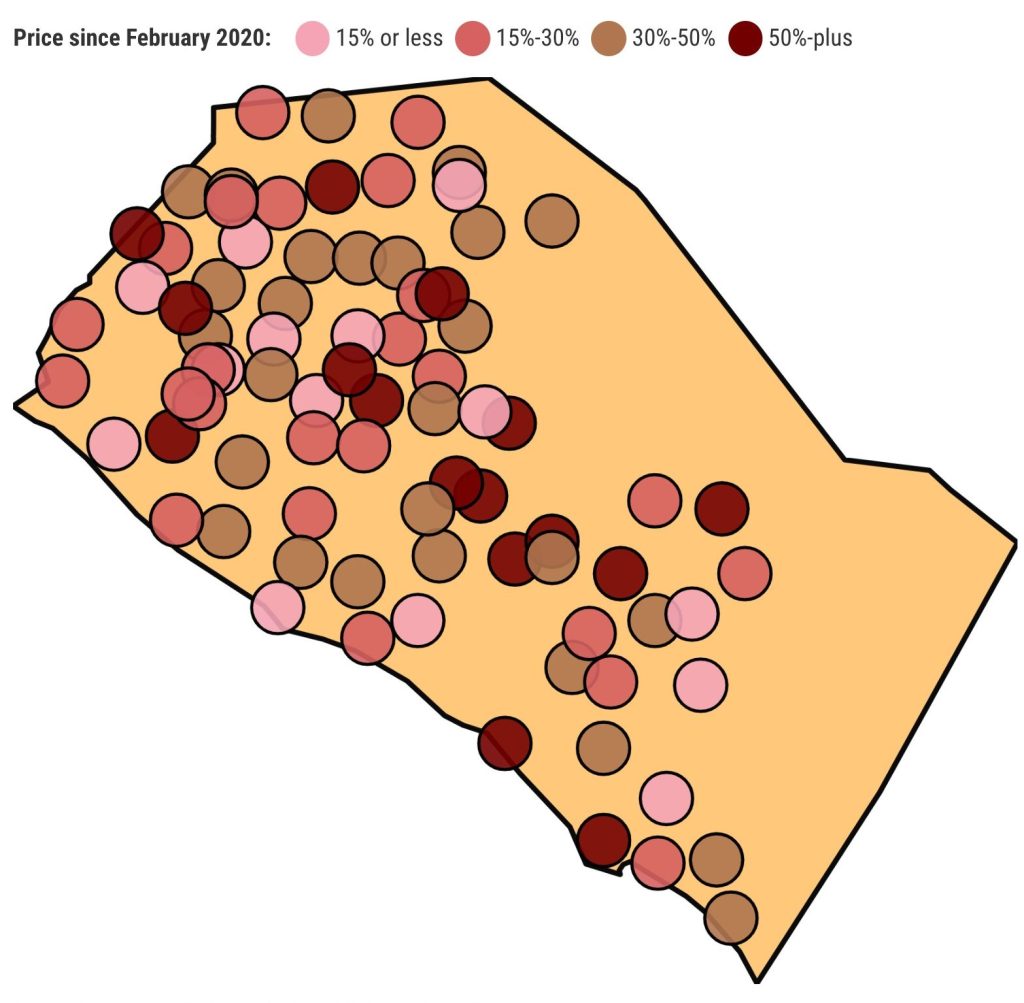

The pandemic dramatically altered Orange County’s homebuying landscape, especially 16 ZIP codes that saw price gains of 50% or more in three years.

My trusty spreadsheet looked at local median sales prices by ZIP code for February and compared them with February 2020, the last month before the coronavirus upended real estate and the economy.

Here’s what we learned …

Big picture

The countywide median price rose 28% in three years to $957,750. That’s a $209,750 boost.

Mortgage rates were a key factor – ending 2019 at 3.7% they fell to a record-low 2.7% in 12 months as the Federal Reserve used cheap money to keep housing from falling in a coronavirus-iced economy.In addition, working and schooling at home due to pandemic restrictions boosted desires for larger living spaces.

But a two-year homebuying binge was snuffed out by the Fed, which reversed its rate policies, pushing mortgage rates as high as 6.9% in October 2022.

Still, huge price gains remain in key Orange County home niches over three years …

Resale houses: Up 31% to $1.07 million.

Resale condominiums: Up 38% to $725,000.

New homes: Up 47% to $1.24 million.

Price matters

The bigger the price, the bigger the gains. That’s because low mortgage rates tend to give more oomph to pricier homes.

So when the spreadsheet sliced the ZIP codes into thirds, ranked by selling prices, the 27 cheapest ZIPs had an average price of $726,306 with 25% three-year gains. But the 27 most-expensive ZIPs with an average $1,702,352 price saw 42% gains.

Or look at pricing changes this way.

In February 2023, there were 13 ZIP codes with median prices of $750,000 or less vs. 45 three years earlier. Compare that with 34 ZIPs priced at $1 million or more in 2023 vs. 13 three years earlier.

Big winners

Locally speaking, 16 Orange County ZIP codes had pandemic-era price gains of 50% or more. Note that neighborhood-level pricing can be very volatile, especially in high-priced communities or towns with lots of new…

Read the full article here