When it comes to filing income tax returns, most Americans worry that they will owe money to the federal government or a state tax collection agency.

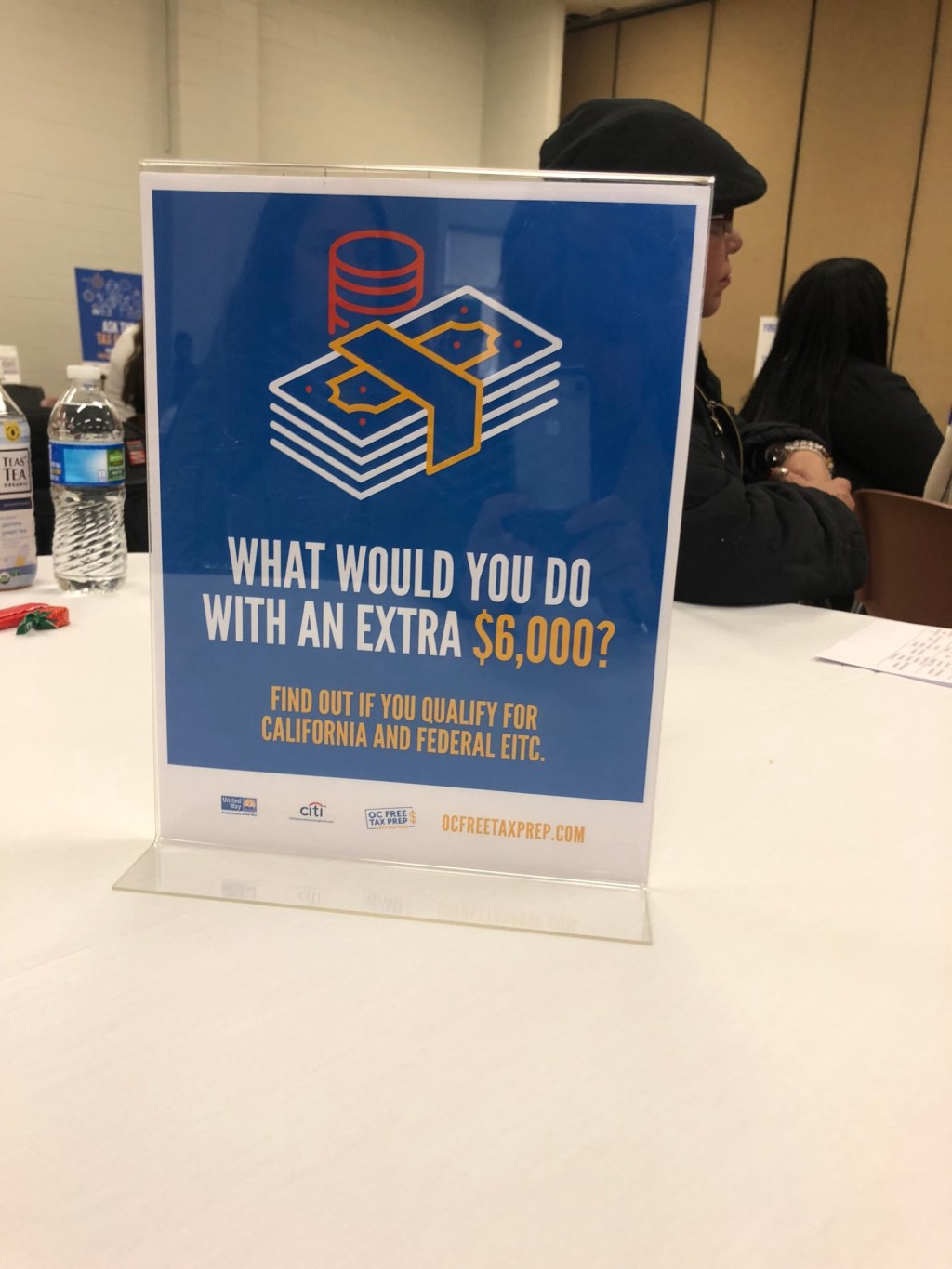

But for thousands of low-income Los Angeles County residents each year, often the opposite is true. The IRS and the state Franchise Tax Board owe them money. But due to uninformed tax preparers or because people fail to file their taxes at all, residents are unknowingly short-changed millions of dollars.

In fact, about $500 million in tax credits that L.A. County residents qualify for are left on the table each year, say nonprofit groups working to reverse the situation.

“Filing taxes and getting the refunds you qualify for is difficult and time-consuming and far too many people don’t get the cash they should as a result,” said Teri Olle, director of Economic Security California (ESCA), the nonprofit spearheading a pilot program to connect more residents with tax-return preparer groups who don’t charge for their service and get more low-income people to file.

Research has found that a significant number of low-income Californians, including a disproportionate number of Black, Latino and indigenous households, are missing out on cash payments offered through state and federal tax credits and stimulus programs, ESCA reported.

The group has a goal of connecting with 3,000 low-income families in L.A. County who qualify for tax credits and refunds through a new program called Claim Your Cash. The group is working with people who receive county services, linking them up with free tax preparers who know about the applicable tax credits that are available.

When someone gets county benefits, the county worker calls the Volunteer Income Tax Assistance (VITA) program and gets the individual an appointment — something ESCA calls “a warm handoff.”

ESCA has trained staff at the following county departments: Department of Children and Family Services (DCFS), Department of Consumer Business Affairs (DCBA),…

Read the full article here