ATLANTA — Fall has arrived, and that means open enrollment for Medicare starts Oct. 15. There are several changes for 2024 that you should know before enrolling or updating your Medicare coverage. Even if you won’t turn 65 for a few more months, now is the time to get to know your Medicare options. Educating yourself now will help you make the right choices once you’re ready to enroll.

What’s new in Medicare

Several Medicare changes took effect in 2024 to help reduce your out-of-pocket costs. These include:

- Your Medicare drug plan cannot charge a deductible or more than $35 for a one-month supply of each insulin product Part D covers.

- Recommended adult vaccines are now available at no cost to you.

- Medicare now covers monthly services for chronic pain treatment if you’ve been living with it for more than three months.

- Medicare now covers more intensive outpatient program services for mental health care at hospitals, community mental health centers and other locations.

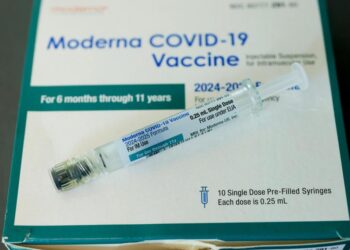

- Medicare covers the COVID-19 vaccine and some related tests and treatments.

New changes for 2025 include:

- Part D plans must limit out-of-pocket costs for covered drugs at $2,000 a year. That includes deductibles, copays and coinsurance. It’s possible your Part D coverage could have a maximum deductible of $590.

- Dementia patients and their caregivers could receive more help through the Guiding an Improved Dementia Experience (GUIDE) program, which provides a 24/7 support line, a care navigator to help you find services, caregiver training, and as much as $2,500 a year for at-home, overnight or adult day care respite services.

It’s imperative to review all plans and options before making a decision. You can do a side-by-side comparison of plan coverage, costs and quality ratings at medicare.gov.

The basics of Medicare

Medicare is health insurance offered through the federal government. You must meet one of the following requirements to…

Read the full article here