“Numerology” tries to find reality within various measurements of economic and real estate trends.

Buzz: What if homeowners are simply not selling because they like their homes?

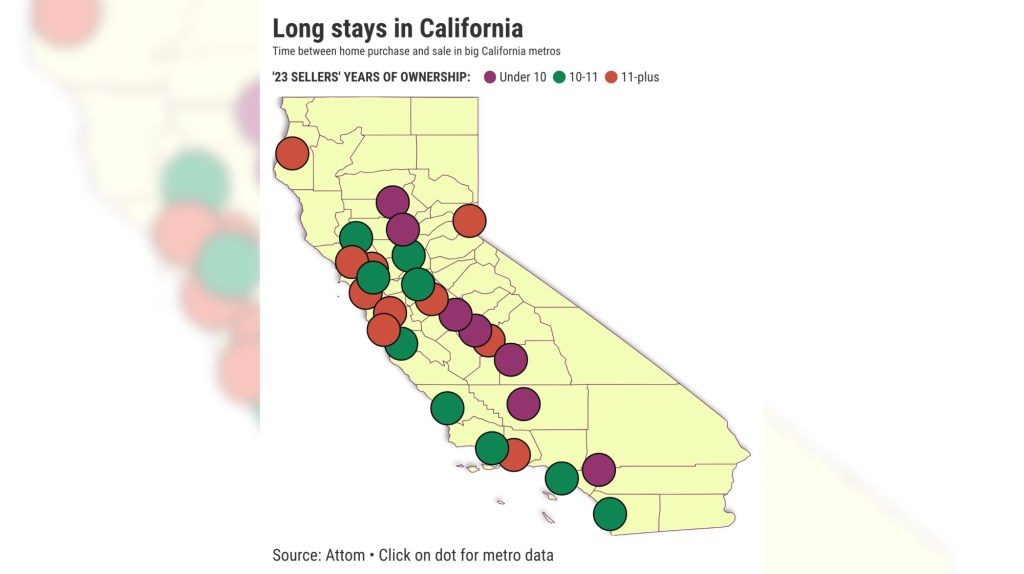

Source: My trusty spreadsheet reviewed home transaction data from Attom tracking last year’s sales by length of ownership, price sold, and profits – the difference between sale and purchase price. The focus was on the 50 most-populated metro areas, including eight California markets.

Fuzzy math: The home-selling industry seems quite upset that homeowners aren’t moving like they once did. Ownership lengths have essentially doubled in the past two decades, and transaction levels tumbled to historic lows in 2023.

Topline

Last year’s sellers in these big California metros owned for an average 10.6 years – up from 9.8 in pre-pandemic 2019 and 5.5 in 2003. That’s ownership duration that grew by eight months in 4 years and was 5.1 years longer over 20 years.

And the typical seller was cashing in on some handsome profits: a $747,500 home with a $311,000 gain.

So you see, the growing length of ownership was happening way before historically cheap mortgages. It’s a similar tale nationally.

Homes sold in the 42 big metros outside the Golden State had been owned for 8.4 years in 2023 vs. 8.2 in 2019 and 3.7 in 2000. That’s two months more over four years and 4.7 years longer over 20. Last year’s typical US seller moved from a $375,000 home with a $174,000 gain.

Bottom line

The why of this all is largely a lot of guesswork.

Some real estate gurus suggest that owners with low-rate mortgages are unwilling to part with their financing bargains obtained in the heat of the pandemic era’s stimulus boom. But conversely, many owners can’t afford to buy anything else – as the sharp rebound in mortgage rates and soaring prices slashed affordability.

Also, selling is quite the hassle – and expensive. Paying for various transaction services – never mind the move itself…

Read the full article here