As tax season ramps ups, accountants will work overtime to ensure complex tax documents – which the Internal Revenue Service claims can be filed by anyone with an 8th-grade reading level – are properly filed.

This special report looks at up-and-comers in the industry: those who chose the partner track and broadened the client base for firms with deep roots in the area.

Los Angeles-based accounting workloads may also overflow from steep budgetary demands as the city’s entertainment industry digs out of last year’s prolonged strikes. Coupled with the broader economic headwinds of tighter capital costs and rapid inflation, those crunching the numbers for blockbusters slated for 2025 or the updated residual payouts have their work cut out for them.

Dealing With Skepticism

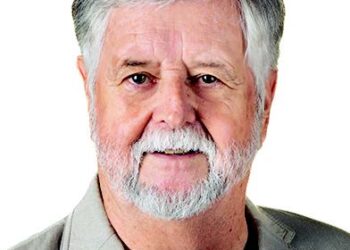

Matt Segal is a business manager with more than 15 years of experience in the entertainment industry working with athletes, entertainers and high-net-worth individuals at the Westwood-based NKSFB, the largest independent accounting firm headquartered in Los Angeles and one of the most prominent Hollywood firms. Responsibilities under his purview include budgeting and projecting expenses, tax planning, estate planning and insurance reviews. Segal was also a part of the group of principals who sued the firm’s parent company, Focus Financial Partners, last year, challenging a noncompete clause in their contracts.

Pressure to reduce costs amid stubborn inflation and rising interest rates was high last year. As macroeconomic conditions teeter towards recovery this year, how are clients pivoting priorities?

Most clients are still very skeptical of the economy and the markets. Very conservative investment processes are in place for most clients as they watch the performance of the economy and wait to see interest rates drop.

Clients’ primary source of income can be impacted significantly and quickly amid a market downturn. How have you seen clients diversify their revenue streams?

Our clients…

Read the full article here