“Numerology” tries to find reality within various measurements of economic and real estate trends.

Buzz: Mortgage rates today would be at 8.9% if they were priced according to this century’s typical spread above the inflation rate.

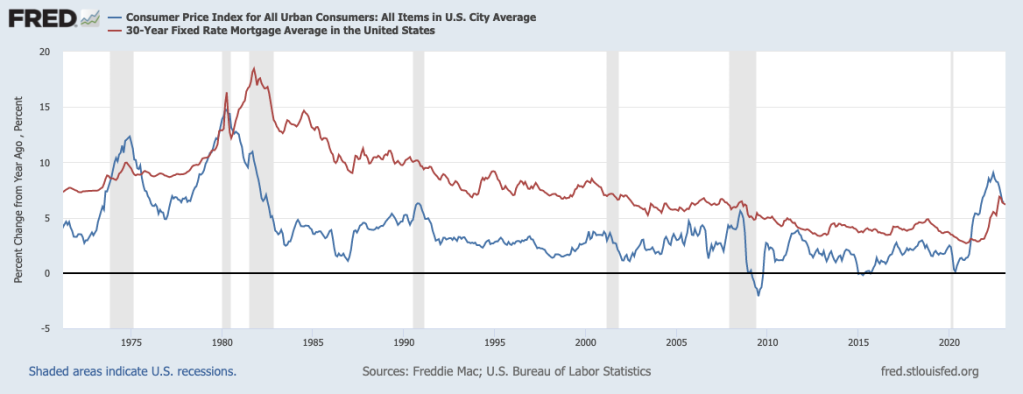

Source: My trusty spreadsheet reviewed the relationship between the monthly average 30-year, fixed-rate mortgage (by Freddie Mac) and the inflation rate (12-month change in the Consumer Price Index).

Fuzzy math: Critics say the Federal Reserve’s inflation battle, which roughly doubled mortgage rates, has gone too far.

Topline

Since 2000, 30-year mortgages averaged 5% compared with 2.5% inflation – that’s a loan rate 2.5 percentage points above the cost of living.

January’s 6.4% U.S. inflation rate – plus that 2.5% historic spread – equals 8.9% for home loans.

But in January, 30-year loans averaged 6.27% vs. the 6.4% inflation rate – with loan rates 0.13 percentage points below the cost of living.

Details

January marked the 22 consecutive month that the mortgage-rate average was below the inflation pace.

That’s highly uncommon as mortgage rates traditionally run above cost-of-living growth. Why? Lenders want to earn more than what inflation gobbles up in terms of buying power.

How odd is it? The history books have only one other streak like this: 20 months that ended in July 1975, a time when inflation soared because of an Arab oil boycott, which inflamed U.S. consumer prices.

In those 20 months, mortgages averaged 9.1% vs. 10.7% inflation – that’s a 1.6 percentage-point gap. In the current streak, which started in April 2021, mortgages averaged 4.4% vs. 7% inflation, with loans sitting 2.6 points below the cost of living’s surge.

This is one of many economic curiosities of the pandemic era. It’s fallout from the Federal Reserve’s unprecedented cheap-money bailout of the housing market that was used to stimulate a whipsawed economy.

I’ll note the current mortgage premium above inflation is swiftly…

Read the full article here