The last time the U.S. housing market was this slow, “Fifty Shades of Grey” topped the box office and “Uptown Funk” was the No. 1 song.

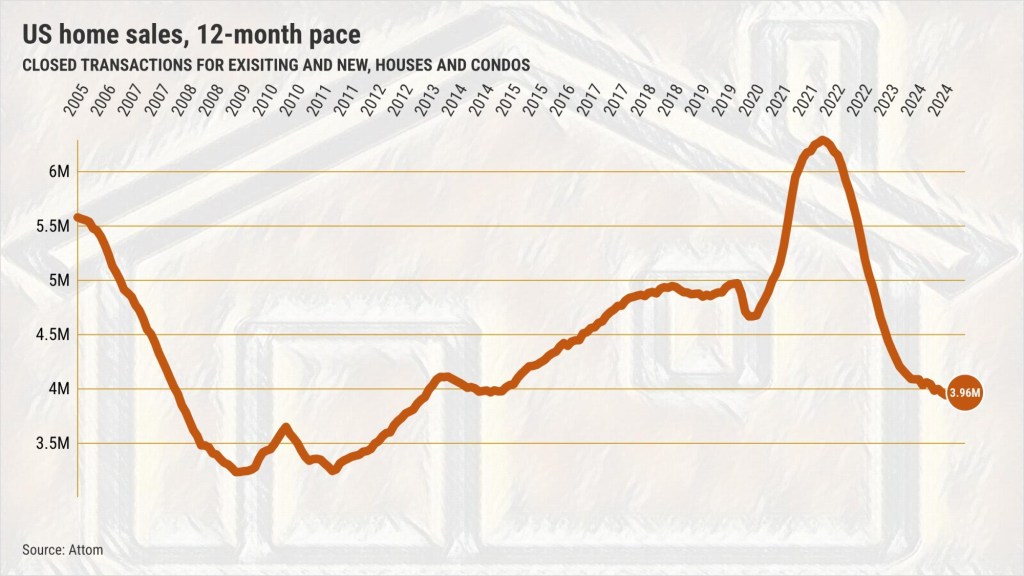

To get a broader glimpse into the nation’s housing market, my trusty spreadsheet reviewed a slightly different set of home sales figures created for the Southern California News Group by the real estate data firm Attom.

Unlike many industry yardsticks that track only existing single-family homes, Attom’s statistics follow closed transactions of all types of residences – newly built and older properties, whether they are houses or condominiums. The data dates to 2005.

These fresh figures tell us that 248,233 U.S. residences were bought in February. That was down 7% in a year and 9% below the 20-year average for the month.

But here’s the most stunning stat: The last time fewer homes changed hands in any month was February 2015. Yes, a decade ago, when the nation had 7% fewer households and Americans were flocking to the movie version of a racy novel and dancing to a Bruno Mars hit.

You see, homebuying across the country has chilled since the Federal Reserve began raising interest rates in early 2022 to fight the worst bout of inflation in four decades. Limited affordability plus economic uncertainty – not to mention stubbornly high prices – scared off many wannabe homeowners.

The price is wrong

Pricier mortgages have not cooled high home prices nationwide.

February’s median U.S. sales price of $352,000 for all residences was the ninth-highest on record and doubled in 10 years. It’s just 4% below the all-time high of $365,000 in June 2024.

Think about affordability going back to February 2015, when the average 30-year fixed loan rate was 3.7%, not the 6.8% of February 2025.

The estimated house payment a decade ago on the $175,000 median-priced residence was $645 a month – assuming a 20% downpayment. The 2025 payment on the $352,000 median was $1,843.

That’s nearly triple the payment pain in a period…

Read the full article here