Kyle Kazan became a longtime supporter of marijuana legalization after he saw firsthand the detrimental effects drug charges could have on vulnerable populations while working as a police officer during the aftermath of what came to be known as the War on Drugs in the 1990s.

He founded Glass House Brands with the goal of making cannabis as affordable in the legalized market as it is when purchased illicitly. Glass House is involved in all aspects of the cannabis industry spanning production, wholesale, retail and consumer packaged goods.

To execute his goal, Kazan knew he needed to produce cannabis in high quantities to get the most out of farming upkeep costs. In 2021, an opportunity came along to purchase a 5.5 million square feet greenhouse farm facility which would give Glass House the ammunition it needed skyrocket production.

In talking with the farm’s previous owner, Kazan was able to strike a deal to purchase the farm for $118 million as well as some stock in the company. The only problem was that Glass House wasn’t public.

Enter the de-SPAC.

A de-SPAC transaction is when a special purpose acquisition company – a blank-check entity created for the sole reason of taking another company public – acquires a private company, allowing it to bypass the traditional IPO process which requires higher levels of scrutiny.

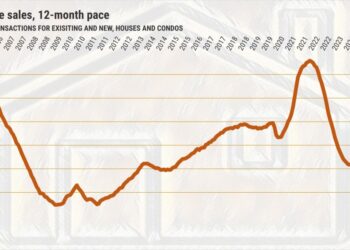

These types of transactions began gaining traction in 2020, ultimately peaking in 2021 when a total of 613 de-SPACs were completed in the United States, compared to 248 in 2020 and 86 in 2022, according to data from SPAC Research. In 2023 and 2024, there were just 35 and 57 de-SPAC transactions, respectively.

It’s clear this trend was short lived as skeptics’ notions surrounding de-SPACs proved mostly true.

During the onset of the de-SPAC boom, James Park, a professor at UCLA School of Law and a former assistant attorney general in the Investor Protection Bureau for the state of New York, found himself “very skeptical” of the…

Read the full article here