Home shoppers hoping for more attractive mortgage rates next year may be disappointed.

That’s the takeaway from several economists’ 2025 housing forecasts, most released over the past couple of weeks.

Most of the eight forecasts call for the average rate on a 30-year mortgage to remain above 6% next year, with some including an upper range as high as 6.8%.

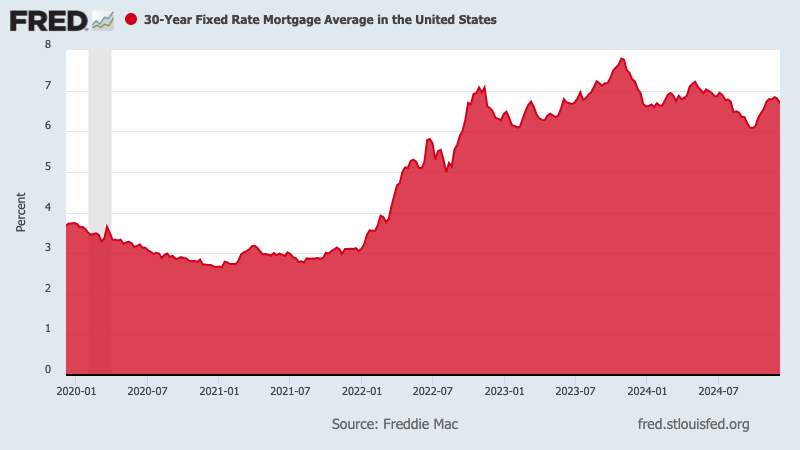

That range would be largely in line with where rates have hovered this year. The average rate has gone as low as 6.08% in September — a 2-year low — and as high as 7.22% in May, according to mortgage buyer Freddie Mac. The average rate was 6.6% last week.

“Even by the end of next year it’s hard to see sub 6% mortgage rates,” said Mark Fleming, chief economist at First American, which predicts the average rate on a 30-year mortgage will range between 6% and 6.5% next year.

The biggest wildcard for mortgage rates next year is whether President-elect Donald Trump’s major policy initiatives will end up driving inflation and the national debt higher, which could keep mortgage rates elevated. That’s because what happens with inflation, the U.S. deficit and the economy can influence moves in the U.S. 10-year Treasury yield, which lenders use as a guide to price home loans.

Trump says he wants to impose tariffs on foreign goods, lower tax rates and lighten regulations, policies that could rev up the economy, but also fuel inflation and increase U.S. government debt.

Economists at Redfin project that the average rate on a 30-year mortgage will hover around 6.8% next year, citing expectations that Trump’s proposed tax cuts would increase the U.S. deficit and his tariffs plan could stoke inflation, ultimately pushing mortgage rates higher.

However, mortgage rates could drop to the low-6% range if the economy weakens or if plans for tariffs and tax cuts are dialed back, according to the forecast.

A couple of forecasts are more optimistic about how low the average rate on a 30-year mortgage will go in 2025….

Read the full article here