Californians have been surprisingly good at paying their bills despite all the financial hurdles of Golden State life.

That’s what I found when my trusty spreadsheet looked at a decade’s worth of consumer delinquency data from the New York Fed. These stats came from Equifax credit histories tracking which debts go unpaid – mortgages, autos, credit cards and student loans.

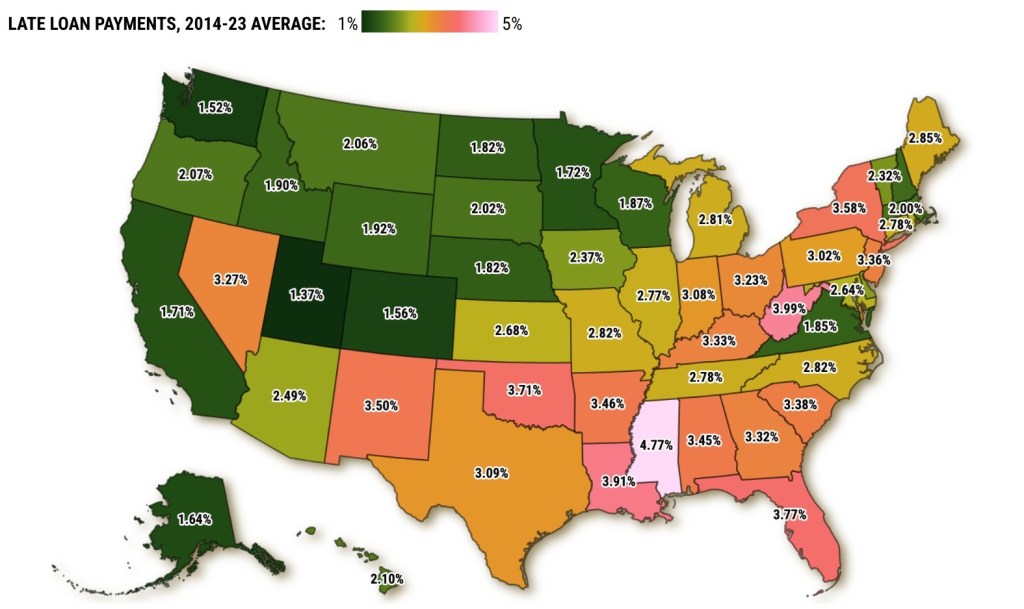

For all the talk about the state’s sky-high cost of living impoverishing scores of residents, Californians had the nation’s fifth-best debt payment rate among the states between 2014 and 2023.

Statewide, 1.7% of combined debt balances in those categories were 90 days or more late – well below the 2.7% delinquency rate nationally. Utah had the fewest missed payments during these 10 years – just 1.4%. Next was Washington at 1.52% and Colorado and Alaska at 1.6%.

And the worst payment patterns? They were found in Mississippi, with 4.8% of debts delinquent. Then came West Virginia at 4%, Louisiana at 3.9%, Florida at 3.8%, and Oklahoma at 3.7%. Oh, and economic rival Texas was 17th-worst at 3.1% late.

Largest debts

Don’t let the good payment history obscure the fact that Californians like to borrow. Some might argue most Golden State residents need significant loans to financially survive.

The California consumer debt load equaled $70,414 per person during the past decade in these four categories. That level of per-capita loans was 45% above the U.S. norm. Only Delaware at $86,905 and Colorado at $70,466 had more.

The smallest debts were found in West Virginia at $27,766 per person, Mississippi at $29,545, and Arkansas at $31,800. And Texas was No. 29 at $42,930 and Florida was No. 26 at $44,273.

But when it came to dollars of late debts, California ranked only 23rd highest among the states – an average $1,206 per capita over the 10 years. And that’s 7% below the U.S. norm.

Tops for tardy balances? Delaware at $2,090 per capita, New Jersey at $1,901, and Maryland at…

Read the full article here