By Rosalie Murphy | NerdWallet

When Kaustubh Deo, president of Washington-based Blooma Tree Experts, bought the company from its retiring owner, he inherited a weekly payroll system and quickly learned to appreciate shorter pay periods.

“If you give somebody a raise, they feel that [increase] like three days after you tell them about it,” Deo says. And payroll errors can be corrected faster, too: “It’s one thing if it’s to wait two weeks or four weeks for that to get resolved, but if it’s next week, employees aren’t that worried about it.”

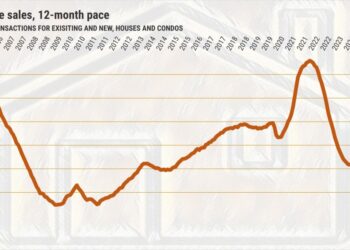

The bulk (63%) of American workers are paid biweekly or twice a month, according to a February 2023 U.S. Bureau of Labor Statistics survey. But around 27% of workers said they were paid weekly. And technologies like earned wage access are giving more workers the option to draw on their wages between paydays.

For employees, less time between paychecks can increase feelings of financial security, says Karen Burke, a knowledge advisor at the Society for Human Resource Management.

Here are two ways small-business owners can start paying employees more frequently.

1. Shorter pay periods

Weekly payroll is already the norm in many industries. In the same BLS survey, nearly two-thirds of construction workers said they were paid weekly.

It’s common in landscaping, too, Deo says. He found that weekly pay was necessary to compete with other employers, some of whom pay daily rates, occasionally in cash.

If [workers] are comparing getting paid cash daily to getting paid every two weeks, the math starts to get harder,” Deo says.

Similarly, Burke explains, a $100 deduction from a weekly check may seem smaller than a $200 deduction from a biweekly one.

“It’s the same thing, but it’s all semantics. It’s how the employees see it,” Burke says. “They can manage their cash flow better.”

To manage payroll, Deo runs each pay cycle through his payroll software, so taxes and benefit contributions are deducted…

Read the full article here