By Whitney Vandiver | NerdWallet

When Marlinda Cesar-Wiley’s 4-year-old son with autism was diagnosed with epilepsy in 2023, she thought he’d finally qualify for Social Security Disability Insurance. But he was denied for the fourth time a few months later.

“It’s been very, very frustrating because I don’t know what I’m doing wrong at this point,” says Cesar-Wiley.

Her son is nonverbal, making it difficult for him to communicate about his epilepsy. He has a Medicaid-sponsored nurse, goes to occupational and speech therapy and receives transportation assistance for appointments. But he has received a string of denials for SSDI benefits.

Cesar-Wiley’s experience is common. Only 31% of SSDI claims were approved, on average, by the Social Security Administration between 2010 and 2019. Here’s why denials happen and what you can do about them.

Stringent requirements

SSDI spells out clear requirements for working credits needed and a monthly income limit for adult applicants or parents applying on behalf of a child, but the SSDI criteria for eligible disabilities can be vague.

Some impairments, such as chronic heart failure, have published eligibility metrics, but conditions that vary in their symptoms and severity leave applicants to prove they are extremely limited in certain abilities.

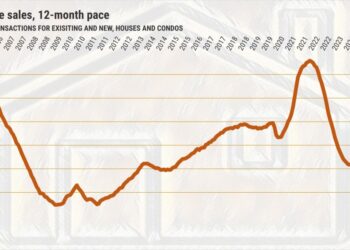

And denials are becoming more pervasive. According to the most recent data, between 1999 and 2021, the Social Security Administration increased the rate of SSDI denials for applicants who were deemed to not qualify for benefits.

“We built a system that is more focused on denying people than it is on getting people the benefits that they need,” says Rebecca Vallas, secretary of the board of directors of the National Academy of Social Insurance. “People often say people are falling between the cracks, and that isn’t what’s happening here. The system is working the way it was designed.”

Complicated appeals process

When Christy Vaal applied for SSDI,…

Read the full article here