A Chino Hills pastor endorsed a candidate for U.S. Senate, renewing a religious watchdog group’s concerns about electioneering from the pulpit.

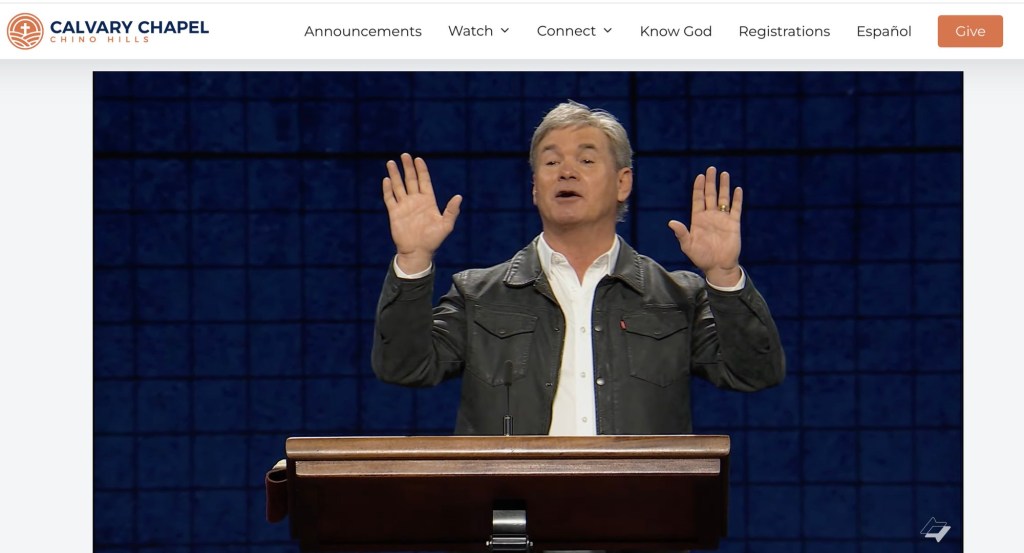

Freedom from Religion Foundation is putting pressure on the IRS to revoke Calvary Chapel Chino Hills‘ tax-exempt status after pastor Jack Hibbs during a Sunday service encouraged the congregation to vote for Steve Garvey for California’s open U.S. Senate seat.

According to the foundation, the rules against such behavior are clearly defined.

In 1954, Congress approved the Johnson Amendment in the U.S. tax code — named for then-Sen. Lyndon B. Johnson, who authored the law — limiting nonprofits from taking part in certain political activities. The limitations meant religious leaders could no longer promote or speak against candidates in any type of official capacity, though they could still take part in public policy debate.

This means that while religious leaders may engage in political movements as private citizens they are barred from doing so in their capacity as ministers or on church grounds, said Eric Allen, a UC Riverside assistant professor in the School of Business.

“You know, the minister is allowed to go to the rally and say this is who to vote for but (not) if it’s happening on-site (at the church) in the capacity of being the minister,” Allen said.

On Tuesday, Feb. 27, a video surfaced on The Right Wing Watch Twitter of Hibbs telling the Chino Hills congregation, “You gotta vote for Steve Garvey.” Hibbs then told the congregation the statement was illegal because he was behind the pulpit, and stepped to the front of the stage to finish his promotion of Garvey, he said, as a “private citizen.”

The IRS website lays out a set of rules that nonprofits and religious organizations are supposed to follow to keep their tax-exempt status.

Churches may not promote propaganda for or against any candidate, under IRS rules. Churches may have candidates come and speak to congregations but…

Read the full article here