Homebuying’s crash in Los Angeles and Orange counties pushed sales down 43% in a year to the slowest January on record.

Home purchases totaled 4,388 in the two counties — down 3,293 from January 2022, according to data from CoreLogic.

So, just how slow was it?

- It was the worst January for sales in records dating to 1988.

- It was the smallest sales total for any month in CoreLogic’s database.

- The percentage sales drop ranked No. 2 largest over 35 years.

- Sales were 48% below the average January pace since 1988.

- Across the six-county Southern California region, sales also fell to an all-time low.

Economic skittishness, especially soaring inflation, plus pricier home loans have frozen the housing market. Surging mortgage rates cut buying power by 28% in a year, making Southern California’s high home prices even more unaffordable.

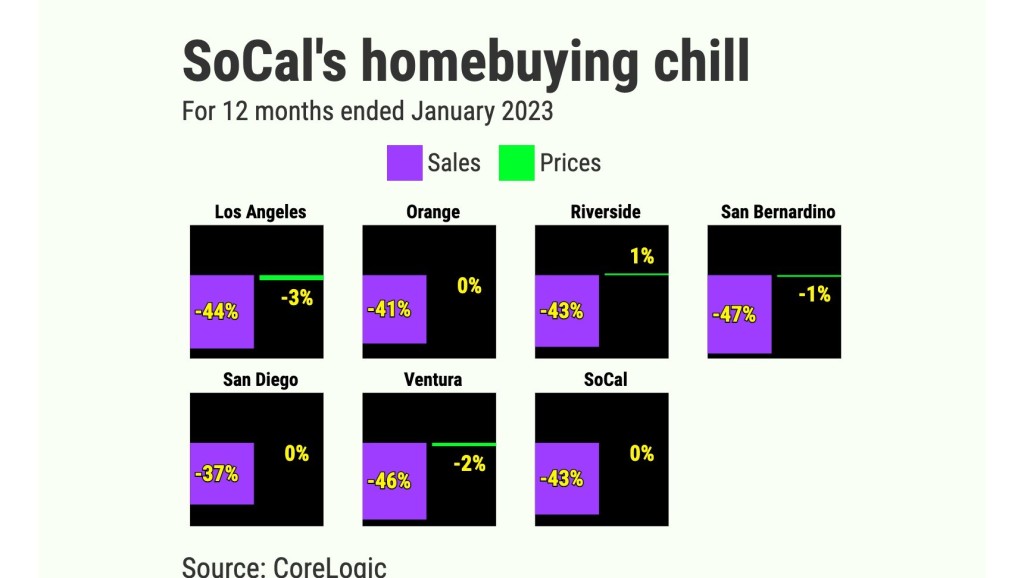

Across the six-county Southern California region in the past year, sales fell 43% to 9,938 as the median sales price fell 0.1% to $670,000.

How cold?

Let’s look at where the L.A.-O.C. cooldown was most intense, starting with January sales.

Los Angeles County had 3,097 closings, down 22% in a month and 44% lower in a year. Orange County had 1,291 sales – down 28% in a month and 41% lower in a year.

Next, consider how prices moved.

In Los Angeles County, the $763,000 median was down 1.5% in a month and 3% lower in a year. It’s also 12% off the $865,000 record high set in April 2022.

Orange County’s $950,000 median was up 1.7% in a month and flat in a year. It’s also 10% off the $1,054,000 peak of May 2022.

Payment pain

Pricier financing is clearly a culprit: The 30-year mortgage averaged 6.3% in January vs. 3.5% 12 months earlier.

My trusty spreadsheet tells me Los Angeles County buyers got an estimated house payment that’s 34% pricier – $3,766 per month on the $763,000 median vs. $2,806 on a year ago’s $786,000 home. And that assumes having $152,600 for a 20% downpayment.

In Orange County, buyers got a 38%…

Read the full article here