By ANNE D’INNOCENZIO

NEW YORK — Target reported on Tuesday a 43% drop in profits and a slight uptick in sales for the holiday quarter, reflecting the discounter’s ongoing challenges of cautious consumer spending and its own higher costs.

The fiscal fourth-quarter results beat retail industry analysts’ expectations. But the Minneapolis discounter issued a cautious outlook for the year as inflation squeezes household budgets. Shares dropped 5%.

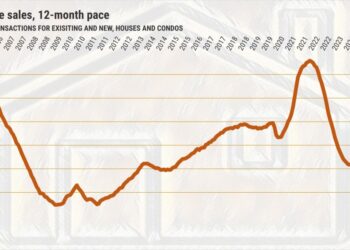

Target’s tempered outlook follows Walmart’s and Home Depot’s tepid annual forecasts last week. Inflation on everything from food to gas that has gripped Americans for nearly two years is weighing on shoppers even though there has been some easing in recent months.

Rising costs also will pressure the Federal Reserve to increase interest rates further and to keep them there through year’s end. That means higher borrowing costs for shoppers.

Walmart said it expects sales at stores opened at least a year for its U.S. business to rise 2% or 2.5% for the year, while Home Depot forecasts growth for that metric to be roughly flat this year compared with a year ago.

For the full year, Target expects comparable sales — those from stores open at least a year and online channels — will range from a low single-digit decline to a low single-digit increase.

“We’re planning our business cautiously in the near term to ensure we remain agile and responsive to the current operating environment,” Target CEO Brian Cornell said in a statement.

He noted that the company entered the year in a “very healthy inventory position,” reflecting its conservative approach in discretionary items like clothing.

Inventory in categories like fashion was roughly 13% lower in the fourth quarter than a year ago.

Target has taken a bigger hit to its business compared to other big box retailers likely because it relies more on discretionary items like clothing and home furnishings. More than 50% of Walmart’s U.S. business comes…

Read the full article here