Darden Restaurants CEO Rick Cardenas got a question on a recent earnings call that even the industry analyst asking it thought was odd.

The analyst wanted to know about what effect diabetes and appetite suppressant drugs such as Ozempic would have on restaurant demand. Cardenas heads the company that owns Olive Garden, home to “never-ending” soup, salad and breadsticks.

“Full-service dining occasions are driven by a desire to connect with family and friends,” Cardenas answered on the earnings call last month, noting he did not expect a “meaningful impact” for his Orlando-based company.

Despite all those breadsticks at Olive Garden, Cardenas said Darden has spent a lot of time over the years developing menus to give guests a wide range of choices.

“If it suppresses appetite a little bit, they’re still going to eat,” Cardenas said. “So we’re going to be there for them when they do.”

Darden has 1,998 restaurants including Olive Garden, LongHorn Steakhouse, Cheddar’s Scratch Kitchen and Ruth’s Chris Steak House.

But it’s not just at Darden where these kinds of questions are coming up. Walmart U.S. CEO John Furner told Bloomberg that the company has seen a “slight pullback” from shoppers taking those medications.

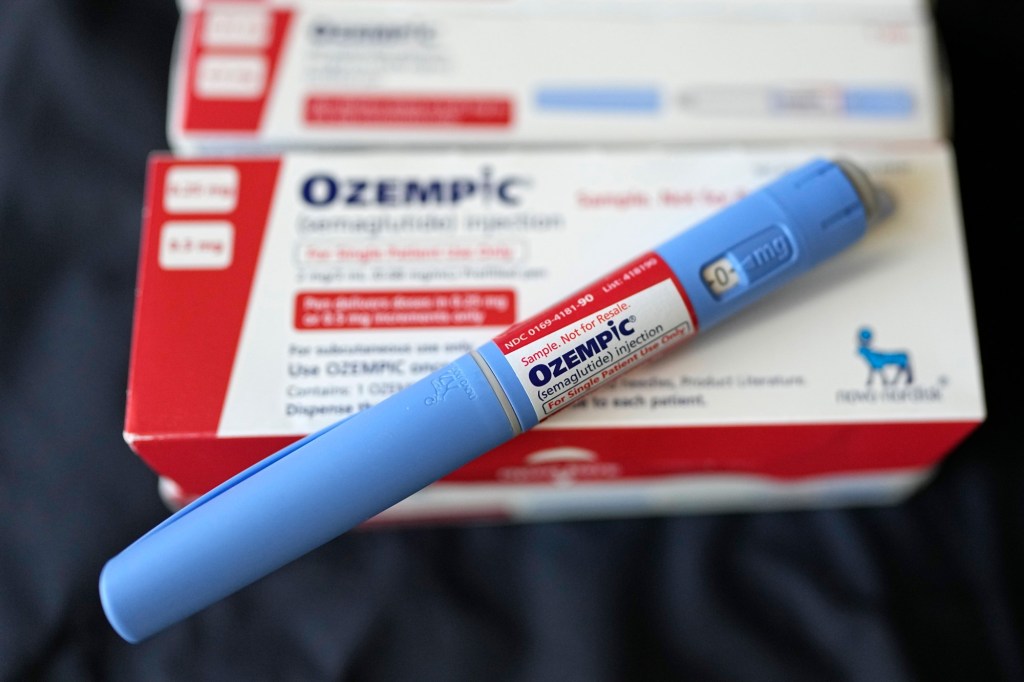

GLP-1 drugs such as Ozempic are Type 2 diabetes medicines that help with blood sugar and might also help with weight loss. According to the Mayo Clinic, the drugs appear to assist in subduing hunger.

Still, restaurant and retail experts say it’s too soon to know for sure what will happen.

“It’s more of a Wall Street story as opposed to a consumer story because if it becomes a big consumer story it would take so long to work its way through all the different consumers,” San Diego-based restaurant analyst John Gordon told the Orlando Sentinel. “I think it would take years to reach mainstream coverage and adaptation.”

One unknown for restaurants, Gordon said, is if the prescription could mean different…

Read the full article here