It wasn’t a very happy holiday season for California’s shoppers.

Sales tax collection stats for 2022’s final quarter showed consumers were cautious about how they spent money.

California’s sales tax collectors say they took in $20 billion on purchases of all taxable goods and services in the fourth quarter, up 7% in a year. Tax collections are a fairly good measure of what’s being bought across the state, though they do miss a key slice of spending – services from personal care to entertainment that isn’t taxed.

The year-end growth was a slight improvement over the third quarter’s 6%. So what’s the problem?

For starters, inflation ran 7% in the past year. So California spending barely kept up with rising prices.

And my trusty spreadsheet found the modest overall growth masks a trouble spot – consumers. Any growth, no less increases above inflation, is hard to find in the tax collection categories heavily tied to what individuals buy.

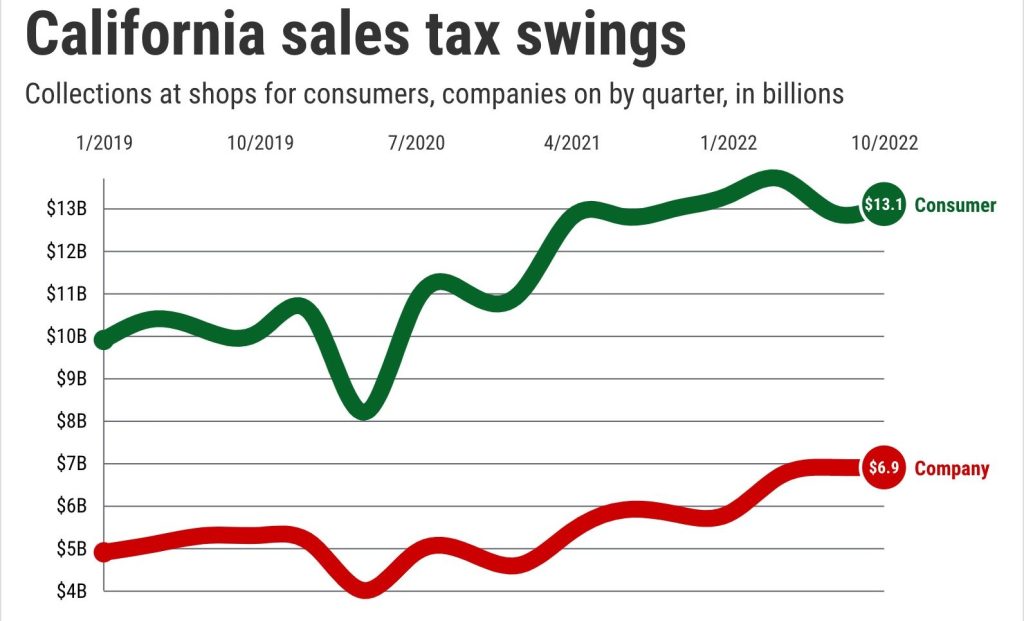

Consumer-oriented sales taxes added up to $13.1 billion in the fourth quarter – up a sub-par 1% from a year earlier. That equals the 1% growth pace of 2022’s third quarter.

Conversely, as consumers were conservatively spending, companies were still in a buying mood. Taxes collected for various business materials and services were $6.9 billion in the fourth quarter – up 19% in a year after 18% gains in the previous quarter.

Lots of worries

Consumers’ year-end shopping chill makes some sense, considering all the conflicting economic signals being thrown at them.

Shoppers can cheer a strong overall jobs market but likely are worrying about the meaning of a year-end filled with news of big layoffs, notably in the tech industry. Big pay raises also are being gobbled up by high inflation. And there’s the suddenly chilled housing market.

Also, the return of everyday life to a somewhat “new normal” – post Covid 19 – certainly alters spending habits.

Plus, year-end 2022’s diminished consumer…

Read the full article here