Thinking about buying a home with a Federal Housing Administration mortgage? Or maybe you’re a vet or in-service military and can buy using a Veterans Affairs or VA mortgage?

It’s best you delay signing that mortgage application until March 20 after the White House announced Feb. 22 that it was lowering annual housing costs on FHA mortgage insurance.

Here’s an example: Assuming a minimum 3.5% down payment on a $500,000 mortgage, the borrower would save $125 monthly because the monthly mortgage insurance premium or MMI will be calculated at a lower rate. Currently, the monthly mortgage insurance is calculated at 0.85 per dollar of the loan. The FHA is lowering that rate to 0.55, effectively saving a borrower $1,500 a year.

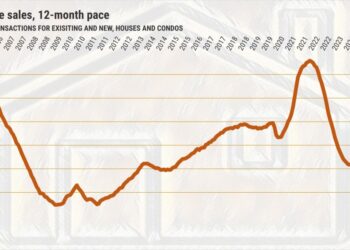

READ MORE: First-time homebuyer pickle: Sparse inventory, high rates, looming recession

If your so-called FHA high-balance loan is from $726,201 to $1,089,300 (for the counties of Los Angeles and Orange) your MMI goes from 1.05% to .75% with less than 5% down. For example, a $1 million loan amount will save you $250 per month, dropping from $875 to $625. You will save $3,000 per year.

The MMI sticks around for the life of the loan in the examples above.

So, why lower the rates now?

FHA’s mortgage insurance fund is overflowing, accumulating a reserve pool “more than five times the required threshold set by Congress,” the White House statement says. HUD was able to recalibrate premiums and pass those savings to consumers “without jeopardizing the long-term sustainability of FHA’s mortgage insurance fund.”

“This is terrific news for borrowers who have been frustrated by the general run-up in mortgage rates,” said Brad Seibel, head at Sage Mortgage. “This reduction will translate directly into lower payments for the consumers and provide first-time homebuyers with a positive lift just when they need it the most.”

Even though more than 80% of FHA borrowers are first-time buyers, you don’t necessarily have to be one…

Read the full article here