Despite sluggish homebuying, Orange County’s median price hit a new high in June as Los Angeles County pricing remains 3% below its peak.

Buyers in the two counties bought 7,574 houses and condos, existing and new, in June, according to CoreLogic. That’s up 2% for the month but down 21% for the year.

How slow is that?

-

- No. 2 slowest-selling June in LA-OC records dating to 1988.

- No. 52-smallest sales total for any month over 35 years, only 12% of all months have been slower.

- 41% below the average June LA-OC sales pace since 1988.

- And the past 12 months? 109,365 in sales was 36% below average.

But think about prices.

OC’s $1.059 million median was up 5.9% in a month and 3% higher in a year. It topped the $1.05 million peak of May 2022.

In LA, the $830,000 median was up 3.8% in a month and 2% lower in a year. But it’s 3% off the $860,000 record high set in April 2022.

It’s all part of a wild first half of 2023 that saw many house hunters grow skittish. Lofty mortgage rates have cut buying power by 13% in a year. Economic uncertainty didn’t help. Yet prices were stabilized by other buyers who were willing to battle for the limited number of homes on the market.

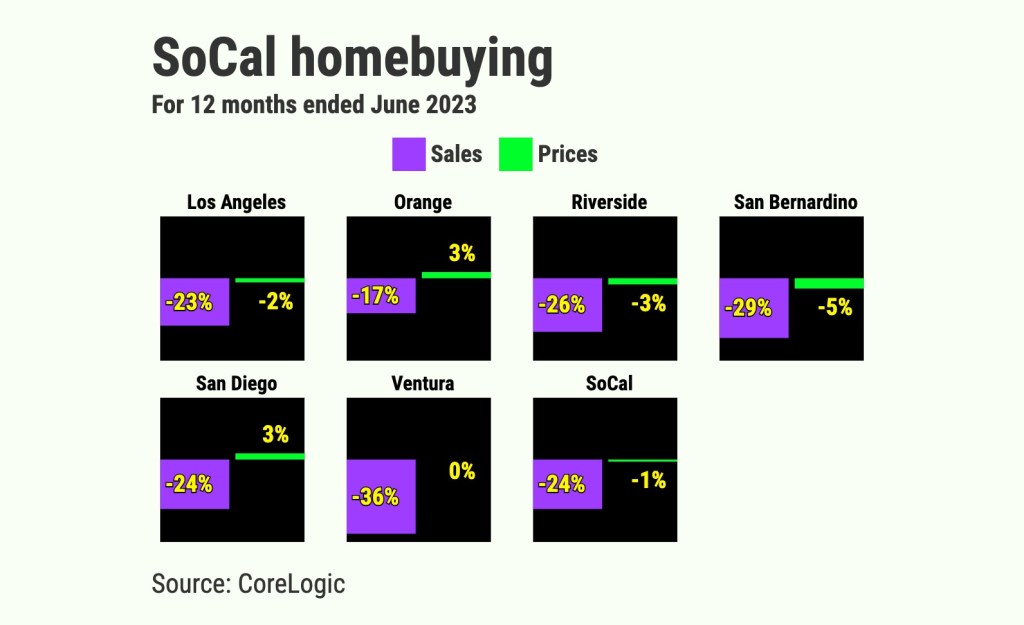

In the six-county Southern California region, sales fell 24% in a year to 16,320 as the median sales price decreased 0.7% to $730,000.

Slow sales

Buying is well below par. Los Angeles County had 5,278 closings, up 2% in a month but 23% lower in a year. Orange County had 2,296 sales – down 0.3% in a month and 17% lower in a year.

Note: An average June sees one-month sales with 6% growth in both counties.

Payment pain

Pricier financing is a factor: The 30-year mortage averaged 6.71% in June vs. 5.52% 12 months earlier.

My trusty spreadsheet tells me Los Angeles County buyers got an estimated house payment that’s 11% pricier – $4,289 per month on the $830,000 median vs. $3,870 on a year ago’s $850,000 home. And that’s assumes having $166,000 for a 20% downpayment.

In Orange…

Read the full article here