If you scan headlines this week, the words “tax deadline” are surely getting attention.

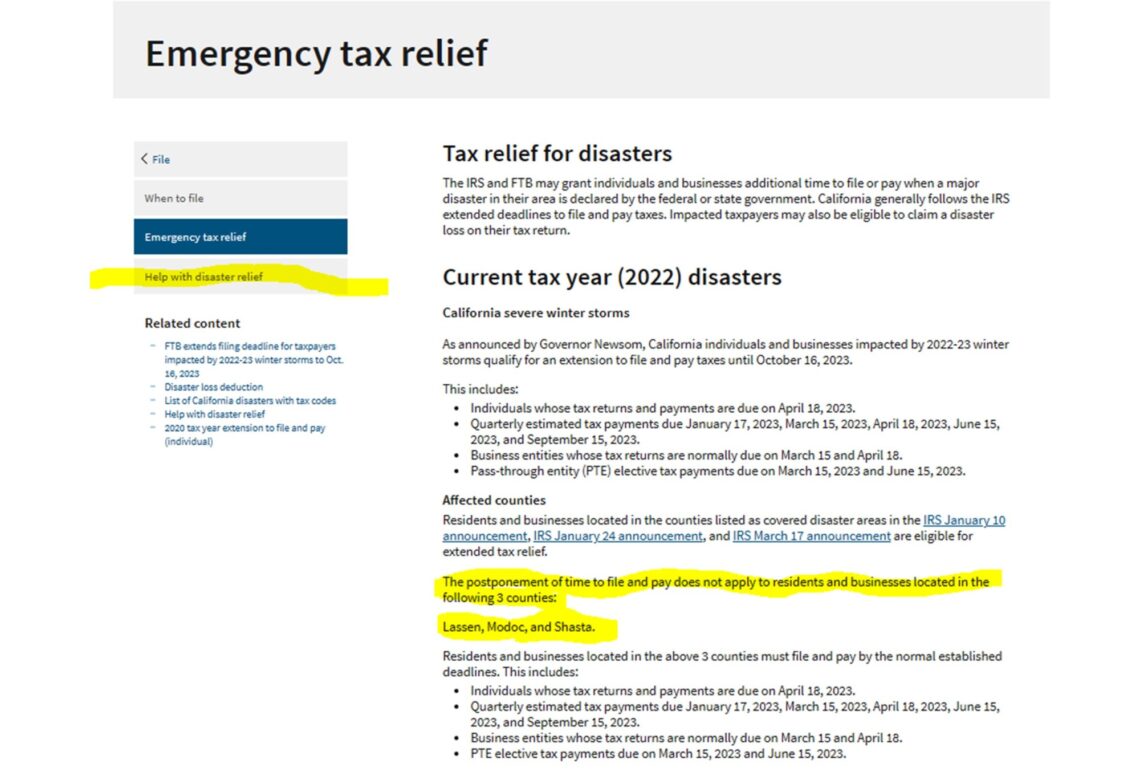

For many across the U.S., the filing deadline for federal returns is Tuesday, April 18. In all but three counties in California, that deadline is Oct. 16, thanks to storm-related declarations by the federal government.

Here’s a breakdown of what you need to know as a California tax filer …

No, you don’t have to file now

Despite what your accountant or tax preparer might say, an automatic extension to Oct. 16 has been granted by both the IRS and Franchise Tax Board.

The postponement of time to file and pay applies to all California counties except three – Lassen, Modoc and Shasta, the FTB told us.

RELATED: Middle Class Tax Refund: Early filers can amend 2022 returns to recoup taxes, IRS says

Why? The extension came after storms and ensuing weather damage prompted the Federal Emergency Management Administration to declare disaster zones (three of them) across the state.

You don’t need any supporting documentation to qualify for the extension, both agencies said. The “gift” of time will be automatically granted when your address is input into the tax return.

The specifics: This extension applies to individual returns and taxes that are due on April 18, 2023, and May 15, 2023, and business entity returns and taxes that are due on March 15, 2023, April 18, 2023, or May 15, 2023.

No, you don’t have to pay now

Several readers asked us if the extension applies to payments, too.

Emphatically, yes, both agencies said.

You can find supporting statements by the FTB and IRS on their respective websites. The language can be convoluted, but at its heart, you’re safe to delay payments to October.

Here’s the IRS’ roundabout way of saying so: “The (disaster) declaration permits the IRS to postpone certain tax-filing and tax-payment deadlines for taxpayers who reside or have a business in the disaster area. Affected taxpayers that have an estimated income…

Read the full article here