Five Facts for Investors to Consider

1. The U.S. economy: Strong (at first glance) The latest GDP data showed that the U.S. economy grew at a 2.9% real (inflation-adjusted) pace through the final quarter of 2022. The headline number implies strength, but digging into the details reveals less favorable dynamics. Three components caught our attention: 1) inventories, which continued to build as goods demand weakened, contributing about half of the growth reported; 2) consumption, which came in solid but slower than expected; and 3) capital expenditures, which appear to be cooling despite firm spending on tech.

2. The bond market: A record start. Bloomberg’s Global Bond Index has surged over 3% in 2023, the best start to a year in over two decades. The prospect of the end of the global tightening cycle is prompting borrowers to seek opportunities to raise financing and making investors ready to take on debt. Global issuance of investment- and speculative-grade government and corporate bonds across currencies reached $600 billion through Jan. 18, the biggest tally for the period.

3. European equities: First inflows in nearly a year. While the sum of inflows was only $200 million three weeks ago, it’s a significant turnaround from near-record outflows just one year ago. The catalyst: The worst-case economic scenario for the region seems to have faded over the past few months. A warmer-than-feared winter has left natural gas supplies near 75% of storage capacity, relative to the nearly 55% typically seen at this time of the season. Looking ahead, investors may look at the still wide valuation discounts, brighter economic growth prospects and a peaking dollar as reasons to keep adding to ex-U.S. exposure.

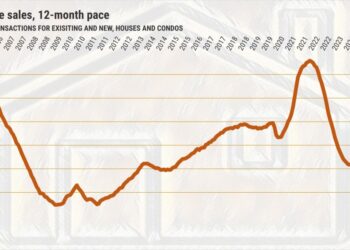

4. Corporate layoffs: The list is growing, yet the stocks are among the best performers this year. The latest tally of layoffs reveal that the companies are persistently contained within tech, finance and real estate – the most interest-rate-sensitive sectors…

Read the full article here